Research

Overview

The Institute recognizes the importance of research in areas of Customs and Taxation to tax administrations and stakeholders. The Institute’s research activities are focused on improving the administration of customs and taxation. The Research Technical Committee (RTC) is responsible for formulation of the research agenda.

The research agenda of the Institute is “Enhancing Tax Compliance” with the following priority research themes:

- Tax compliance

- Taxation of the SMEs

- International taxation and transfer pricing

- Taxation of specialized sectors (oil and gas, telecommunication, financial services, and mining)

In order to ensure focus, efficiency and equity, the research activities of the institute are guided by the REVISED ITA RESEARCH POLICY 2025.

Subcategories

Journals Article Count: 1

Journals

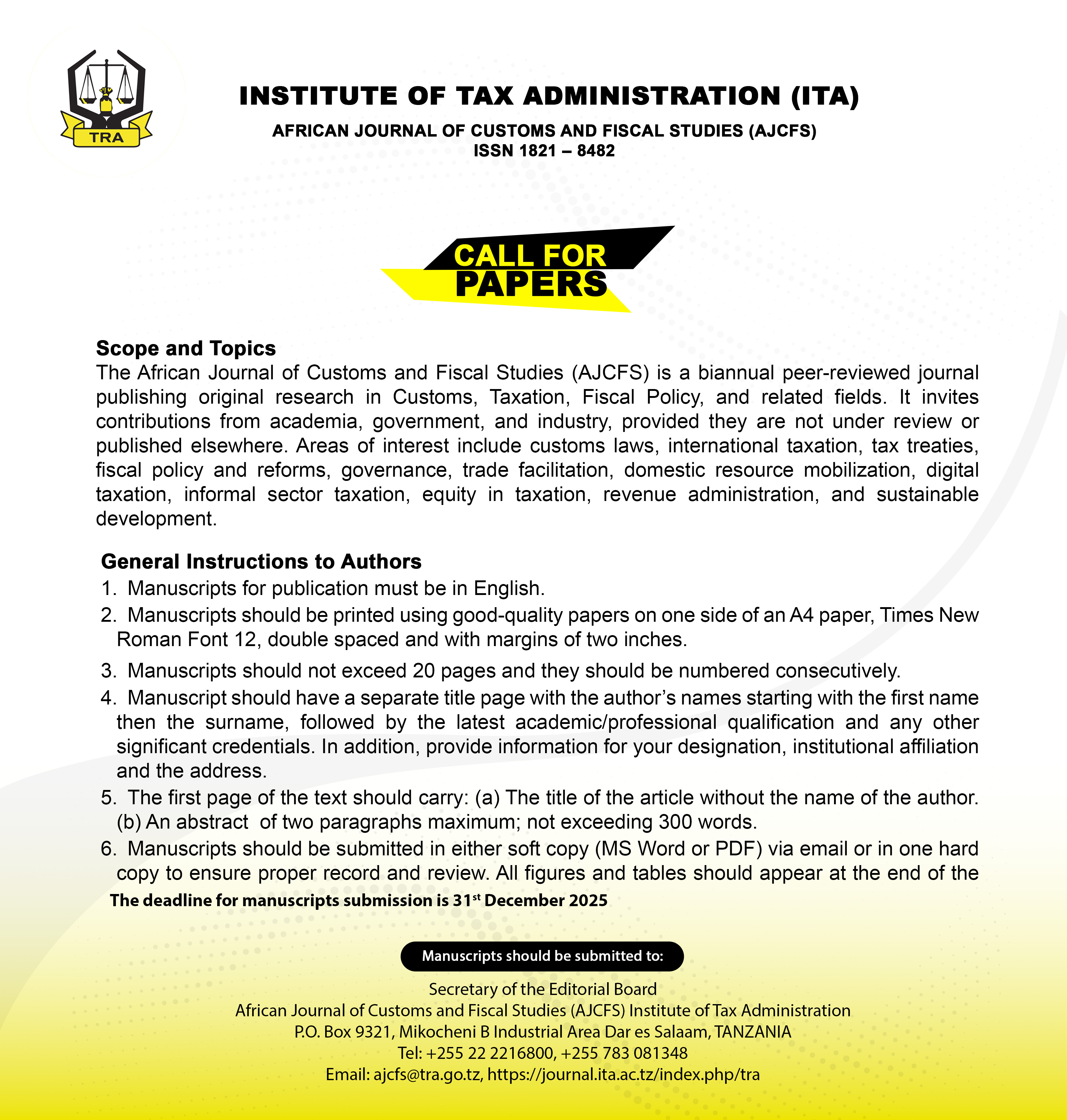

The Institute publishes a scholarly peer review journal, The African Journal of Customs and Fiscal Studies (AJCFS) – ISSN 2665 – 0517 (print) and ISSN 2665 – 0519 (online). The journal is published annually and has a scope broadly interpreted to include such areas as policy, law and administration in customs, regional integration, international trade and taxation at different tiers of government. The AJCFS was formerly known as Journal of the Institute of Tax Administration (JITA) which was published biannually focusing on the same areas as the current journal.

The Editorial Board of AJCFS is composed of following members:

|

University of Dar es Salaam School of Law |

- Chairman |

|

Eastern and Southern Africa Universities Research Program (ESAURP) |

- Member |

|

University of Dar es salaam, Department of Economics |

- Member |

|

Muenster University |

- Member |

|

University of Dar es salaam Business School |

- Member |

|

Institute of Finance Management |

- Member |

|

Institute of Finance Management |

- Member |

|

Institute of Tax Administration |

- Member |

|

Institute of Tax Administration |

- Secretary |

Previous Issues of AJCFS

Volume 1, Issue 1

Instructions to Authors

The JITA Editorial Board invites submissions of original research results from both academia and practice in the form of journal papers. A manuscript submitted for publication in JITA must neither have been published nor be under consideration for publication elsewhere, either in part or its entirety.

Authors wishing to submit article manuscripts are advised to follow JITA Editorial Policy and Instructions to Authors.

For subscription and submission of manuscripts contact:

The Coordinating Editor,

The African Journal of Customs and Fiscal Studies (AJCFS),

P.O. Box 9321, Dar es Salaam, TANZANIA

Tel: +255 22 2780269

Fax: +255 22 2780161

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

ITA TRA - Research and Consultancy Policy Article Count: 1

Research Interests Article Count: 1

Research Interests

Faculty members are involved in various research activities in the broad areas of Tax Policy, Customs policy, Customs law and administration, Tax law and administration, International taxation, Tax compliance and revenue mobilization, Local government tax administration, Accounting and Finance, Risk Management, Strategic planning and management, Project monitoring and evaluation, ICT and revenue administration systems.

Research interest of individual faculty members can be viewed through their profiles.

|

Customs Law, Policy and Administration |

||

|

Mr. Jocktan Kyamuhanga |

Mr. Suweid Faraj |

Mr. Pius Kibahila |

|

Mr. Rogasian Shirima |

Mr. Kasty Phelician |

Mr. Ahmad Mohamed |

|

Mr. Amos Benjamin |

Mr. Edward Mwakimonga |

Dr. Joyce Sichone |

|

Ms. Mary Ruhara |

Mr. Michael J. Marere |

|

|

|

||

|

Tax Law, Policy and Administration |

||

|

Prof. Isaya J. Jairo |

Dr. Lewis J. Ishemoi |

Dr. Amos Ibrahim |

|

Mr. Emmanuel Massewe |

Mr. Emmanuel Masalu |

Ms. Stella Cosmas |

|

Mr. Phillip Mbati |

Ms. Pilly Marwa |

Mr. Joseph Chikongoye |

|

Mr. Richard Donati |

Ms. Rosemary Mwandu |

Ms. Asha Nassor |

|

Ms. Rufina Milamo |

Mr. Ryoba Mzalendo |

Mr. Alfred. J. Kimea |

|

Ms. Hamida Msofe |

Mr. Pascal Gomba |

Mr. Haji J. Mkwawa |

|

Mr. Noah Athanas |

Mr. August O. Kessy |

Ms. Evelyne Mwambije |

|

Mr. Praygod Chao |

Ms. Rukayya S. Abdallah |

Mr. Elly Mloso |

|

Mr. Innocent Nyamvulula |

Mr. Haji J. Mkwawa |

|

|

|

||

|

Decision Sciences |

||

|

Ussi H. Hussein |

Cyril Chimilila |

Justin Musa |

|

|

||

|

Economics and Fiscal Policy |

||

|

Dr. Amos Ibrahim |

Ussi H. Hussein |

Cyril Chimilila |

|

Justin Musa |

Rufina Milamo |

|

|

|

||

|

Accounting and Finance |

||

|

Prof. Isaya J. Jairo |

Dr. Amos Ibrahim |

Dr. Joyce Sichone |

|

Mr. Emmanuel Masalu |

Mr. Ahmad Mohamed |

Mr. Philip Mbati |

|

Mr. Praygod Chao |

|

|

|

|

||

|

Management and Humanities |

||

|

Mrs.Tunu Mwiru |

Ms. Caroline Mutayabarwa |

Mr. Ibrahim Mshighati |

|

Mr. Haji J. Mkwawa |

Ms. Asha Nassor |

Ms. Stella Cosmas |

|

Mr. Michael J. Marere |

|

|

Consultancy Article Count: 1

Consultancy

Being a higher learning institution, ITA promulgates consultancy as one of three pillars namely; training, research and consultancy. The Institute offers a wide range of consultancy services in areas customs, taxation and related fields for improving delivery of customs and taxation services, improved taxpayer compliance and revenue collection. The consultancy activities of the institute are guided by the ITA Research and Consultancy Policy 2012.

The Institute is one of the dependable consultancy providers in the areas of customs and taxation in the East and Southern Africa region. The Institute has forged MoUs with revenue administrations, local governments and other governmental institutions in the region through which it provides capacity building of staff, improve revenue administration systems and research.

Among the consultancy projects implemented recently by the Institute include:

- Capacity building of three States of South Sudan Republic on tax policy and administration

- Capacity building of Ministry of Finance and Commerce of South Sudan Republic

- Capacity building through training of staff of Botswana Unified Revenue Service

- Training on taxation of International Hotels, Botswana Unified Revenue Service

- Development of Revenue Administration database for South Sudan Revenue Authority

- Capacity building on revenue forecasting and fiscal to staff of Zanzibar Revenue Board

- Study on developing compliance model and strategy for widening tax base and enhancing voluntary tax compliance by engaging the informal sector in Zanzibar

- Capacity building of local government tax administrators in Tanzania

- Studies on local government taxation in various local government authorities in Tanzania

- Capacity building of staff of the Parliaments of the United Republic of Tanzania

- Capacity building of Members of Parliaments of the United Republic of Tanzania

The Institute offers to provide consultancy services to a wide range of stakeholders on demand. The Institute has well-qualified staff who are actively involved in provision of consultancy services.